What is Probate?

Probate is the process of proving a will. It occurs after someone dies. All estate administration proceedings are involved in this process.

It’s the practice of deciding what to do with someone’s stuff after they die.

A person’s “estate” is their property at the time of death.

Some property passes directly to others. These include properties held in joint tenancy, life insurance proceeds and retirement plans payable to a named beneficiary.

Everything else may be subject to probate.

Estates are usually “probated” in the county where the deceased owned property.

If property is owned in several states, further actions are sometimes needed in those states.

Why Probate?

To decide if the deceased left a legal will

To assign an executor or administrator (surviving spouse, adult child, bank or trust company) to manage the deceased’s estate

To collect and define all property of the estate

To protect the property of the estate

To give a way to change assets into cash so it can be distributed to the people who benefit from the will (beneficiaries) or paid to creditors

To pay existing taxes and debts in a prompt manner

To figure out who has a right to share in the estate and to divide the property to the correct parties

To transfer legal ownership of real estate and other property

To extend the court’s protection to the person who settles a deceased’s affairs and distributes the property

NOTE: There may be special circumstances where all persons interested in an estate, by agreement of all parties and after review with their lawyers, conclude that formal probate actions are unnecessary.

However, anyone who deals with the deceased’s property without qualifying as an executor or administrator can be held personally responsible for his or her conduct and should be fully advised by counsel before acting.

What is Involved?

Naming an Executor: The will usually names an executor to manage the estate assets. If there is no will, the court will appoint an administrator.

Duties of the Executor: The executor or administrator, normally under the guidance and direction of a lawyer, is personally responsible for the proper handling and settlement of the deceased’s estate.

The executor or administrator will usually be required to:

Notify heirs and creditors of the probate proceedings.

Take possession of inventory and preserve the probate assets of the deceased.

Collect all income, such as rents, interest and dividends, demand and collect all debts, claims and notes due.

Manage the deceased’s business.

Determine the names, ages, residences and degrees of relationship of all heirs and closest relatives of the deceased.

Complete any pending lawsuits in which the estate of the deceased has an interest.

Determine, prepare returns for, and pay all state and federal inheritance, estate and income taxes.

Pay the valid claims of creditors of the deceased and, when needed, sell property to raise funds to pay claims, taxes, and expenses of administration.

Transfer a deceased’s title to real and other titled property to his or her heirs.

Distribute all remaining assets to the proper persons.

The process: Probate procedures in Kansas are not hard, but they need some practice. To achieve the desired results they must be handled with a grasp of the basic legal principles.

These proceedings may require: preparing and filing several legal documents; giving or publishing notices, holding court hearings; getting appraisals of property, preparing income, gift and estate tax returns; providing an accounting of funds; distributing property and securing the final release of the executor or administrator by the court.

What is the Role of the Court?

All probate proceedings are subject to the authority of the District Court.

With the exception of certain actions such as estates administered under the Simplified Estates Act and Informal Administration Act, the acts of the executor or administrator are subject to the scrutiny and approval of the court.

Final determinations are made by the Court, including payment of debts which exceed $1500, allowance of lawyer, executor or administrator fees, and orders of final distribution of the assets.

Juries are not used in probate matters.

How Long Does Probate Take?

The first step to probate is to file a petition.

Filing must happen within 6 months after the date of death. Persons having knowledge and access to a will may offer it for probate at any time within the 6 months following the death.

The filing of state and federal death tax returns may be required and tax payments are due no later than 9 months after the date of death.

After filing/beginning of probate:

Appointing an executor or administrator usually takes 4 to 5 weeks from the date the petition is filed.

Creditors have 4 months after actual notice to file claims against the estate.

Since the problems of each estate differ, no exact time schedule can be given for the length required to probate the estate.

However, no estate with assets amounting to more than the legal allowance and debts, taxes and costs may be closed before 6 months after the date of death.

What Property is Included in the Probate Process?

Not all property owned by the deceased is subject to probate.

For example:

Life insurance will pass directly to the chosen beneficiary and does not require probate unless the beneficiary is the insured’s estate or executor.

Titles to joint tenancy property with right of survivorship pass automatically to the surviving joint tenant(s), subject to possible tax liability.

A bank account with a “pay on death” provision will pass directly to the named party.

Transfer on Death provisions are available with respect to securities, titled vehicles and real estate.

Property not subject to probate will not pass under the deceased’s will. This may weaken or destroy the deceased’s wishes about distribution of his or her property.

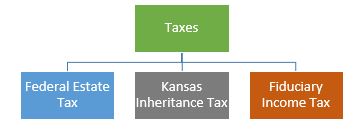

What Taxes are Involved?

The taxable estate is different than the probate estate.

It includes both probate and non-probate assets.

Every estate may be subject to several types of death taxes, depending on the total value of all assets included in the taxable estate and to whom the assets pass.

A. Federal estate tax: It is based on the value of the assets in the taxable estate. The federal estate tax is a graduated tax which is imposed on the net estate after allowing for certain deductions and exemptions. The exemptions are large, so many estates will owe no tax. You should consult a lawyer.

B. Kansas Inheritance Tax: This tax is based on the value of the assets received from the deceased and the heirs’ degree of relationship to the deceased.

However, the Kansas Inheritance Tax may be payable even though no federal estate tax is due.

Kansas real estate cannot be transferred with clear title after the death of an owner or co-owner without obtaining a Kansas Inheritance tax Waiver.

The Waiver is filed with the Register of Deeds in the county in which the property is located.

The only exception from this requirement is when the deceased died more than 10 years before the transfer.

C. Federal and state fiduciary income tax: This tax is based on income and expenses created from the probate estate assets. This tax is like the federal and state personal income tax.

NOTE: The obligation to prepare and file tax returns and pay the appropriate tax liability may exist even if the deceased left no probate estate.

This is because jointly held property, life insurance and certain types of transfers by the deceased before death are subject to taxation by the state and federal governments.

Due to the complexities involved, an executor or administrator should not try to draft the necessary returns, compute the taxes due nor meet the necessary filing requirements without the supervision and guidance of a lawyer.

What are the Fees and Costs?

The fee of the administrator and lawyer are not fixed by any law or court rule.

They must mirror the fair value of the services actually performed in relation to the size of the estate.

The fees of the executor or administrator and lawyer are subject to the approval of the probate court.

The estate administration costs include court costs, which are set by law, publication costs, and bond premiums if a bond is required by the court.

What About Small Estates?

The laws of Kansas say that when the deceased leaves a spouse or minor children, a simplified proceeding may be used when:

The estate is made up entirely of personal property

The estate does not exceed the amount of exempt property

The estate does not exceed the maximum family allowance of $25,000

It’s called a “Refusal to Grant Letters of Administration."

This proceeding can also be used by a creditor where the deceased’s estate consists of real and personal property which does not exceed $25,000, and where there is no claim for family allowance by surviving spouse or minor children.

The availability of the “Refusal to Grant Letters of Administration” process can be determined by the lawyer and the executor or administrator at the time of the initial conference.

Probate can be avoided if the estate has no real property and the value of the estate is less than the total value of all demands against the estate.

Any person possessing a will may then file it with an affidavit. If assets are discovered later, the will can then be probated and the assets distributed according to the will.

IF the deceased had no will and left only real estate to the surviving spouse and other family members, a “Determination of Descent” proceeding may be started at any time 6 months after death.

This proceeding takes about 30 days to complete and is often used when reasons to probate administration do not exist.

NOTE: Even if a “Refusal to Grant Letters of Administration” or a “Determination of Descent” proceeding is used, there may be Kansas Inheritance Tax and federal estate tax filing requirements.

What Should be Done?

Property: If someone close to you has died, nothing should be done to disturb any of the property of the deceased unless it is necessary to protect it from being lost or destroyed.

Who to call? Shortly after the death, a lawyer should be contacted to discuss the matter with those close to the deceased.

In general, the surviving husband or wife should make the initial contact if he or she lived with the deceased.

In other situations, it is recommended that the closest relatives contact the lawyer.

The lawyer will give advice, figure out if probate proceedings will be needed, and explain the procedures involved.

If you have a will of a deceased person, you should give it to the lawyer at the first consultation.

Attending to the details of a probate proceeding may be a complex, time-consuming task, and it may be necessary for relatives or close friends to face this task in a time of grief and trauma.

A lawyer has the technical ability to smoothly handle the necessary legal procedures and relieve those grieving of this burden.